Start the year strong with EAA’s web sessions for 2025, featuring a range of topics designed for actuaries to stay ahead of industry trends, enhance their skills, and earn CPD credits. In the first quarter of 2025, we are offering key sessions in areas such as Actuarial Data Science, Climate Risk Stress Testing, and Enterprise Risk Management, with the opportunitiy to earn the EAA Certificate in Actuarial Data Science.

Our web sessions are led by international experts and tailored to provide practical insights and advanced knowledge. Whether you’re diving deeper into machine learning for insurance, exploring data science fundamentals, or tackling climate risks, these sessions offer valuable learning experiences that directly apply to the actuarial profession.

Below, you can find the web sessions scheduled for January, February, and March 2025, including links for further details and registration.

Web Session 'Adding Value Through Risk Measurement: Capital Allocation & Beyond'

on 29 January 2025 | 10:00-12:00 CET

Risk diversification is at the heart of insurance. In a modern Enterprise Risk Management (ERM) approach, a company’s entire risk profile – including risk diversification and concentration – must be considered in decision-making processes such as insurance pricing, product design, asset allocation and reinsurance. The impact on risk-oriented performance measures such as return on risk-adjusted capital (RORAC) and economic value added (EVA) must also be assessed.

For risk managers, it is therefore essential to assess not only the overall risk of the enterprise, but also the impact of individual risks, business units and hedging instruments on the overall risk. In this context, the term “capital allocation” is a widely discussed and used concept. The gradient (also known as Euler) capital allocation principle plays an important role. The principle is directly linked to “marginal capital requirements” and is compatible with the performance measures mentioned above.

However, the proper implementation of capital allocation in risk management, risk limiting, and decision making often imposes significant challenges. On the computational side, the gradient allocation principle requires determining the derivative of the risk measure—typically Value-at-Risk or Expected Shortfall—with respect to business volumes or other decision variables. Obtaining these derivatives is numerically challenging, especially when risk measurement relies on Monte Carlo simulations. We demonstrate methods to enhance the stability of these estimations, such as kernel estimation. In addition, the allocation has the limitation of accounting only for the risk diversification effects of the current portfolio, which can easily become invalid if the portfolio changes and new risk concentration and diversification patterns emerge. To tackle this issue, we present a recently developed methodology called “Orthogonal Convexity Scenarios” (OCS), which helps to proactively identify potentially adverse portfolio shifts and integrate them into risk management and business steering.

Web Session 'Climate Risk Stress Testing for Physical Risk from Natural Hazards'

on 4 February 2025 | 9:30-13:00 CET

This session will cover various practical aspects around physical climate risk modelling and scenarios analysis, including:

- Understanding how climate change affects different natural catastrophe risks for insurers.

- Exploring the modelling of physical hazards under climate change for location-based portfolios and discuss peer-reviewed data that can be leveraged for this assessment.

- Step-by-step walkthrough of key elements for preparing and performing a climate risk stress test for a property portfolio and illustration based on a case study.

- Discuss results from a case study focusing on flood, wildfire, and tropical cyclones for selected countries, and highlight common challenges in application.

- Highlight key assumptions, limitations, and uncertainties surrounding this assessment.

Web Session 'Risk Mapping for Social Security Pension Systems'

on 11 February 2025 | 10:00-11:30 CET

The aim of this session is to provide social security actuaries and other interested experts with a coherent and adaptable method to manage the risks that pension systems inherently entail.

While all enterprises and institutions have governance and organisational structures, what sets pension systems apart is their individual mission and approach to fulfilling it. Based on these unique characteristics, we have defined a new approach for the main risk categories for all organisations as governance and organizational structures, own specific business, and operations of these organisations. The general ERM approach has served as the common starting point in finding the similarities and differences between pensions and other financial institutions: their processes and methods are similar, but the objectives differ.

Pension funds as financial institutions trade in risk and money, collecting contributions, and paying out pension benefits. A multi-pillar system is an old-age risk management tool as it is. In a three-pillar pension system, the pillars are usually defined by their adequacy objectives and risk appetite of the targeted socio-economic group. By including affordability and robustness in the definition, we have arrived at the core concept of the COSO risk framework with appetite/tolerance and performance/target coordinates. This strategic integration not only enhances our understanding but also facilitates the systematic development of a Risk Management Framework tailored to social security pension systems.

Establishing a Risk Management Function and a regular Own Risk Assessment reporting framework would be beneficial for Social Security Administrators. Actuarial reviews of the financial health of social systems are contributing to risk monitoring and risk mitigation. A holistic approach to risk management will ultimately result in better government and improved benefits for social security systems.

Web Session 'Actuarial Data Science – Basic'

on 13-15 February 2025 | 9:00-17:00 CET

Organised by the EAA – European Actuarial Academy GmbH in cooperation with the Aktuarvereinigung Österreichs (AVÖ).

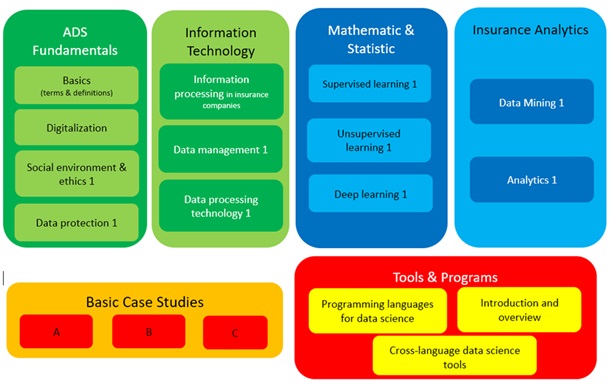

This is part one of four courses (seminar and exam) to obtain the additional title Certified Actuarial Data Scientist by the AVÖ and/or DAV. Participants who do not hold an AVÖ or DAV membership have also the opportunity to obtain a newly established EAA Certificate in Actuarial Data Science by taking part in all four modules and the corresponding exams.

In this first module we intend to give an introduction to the concepts of Actuarial Data Science and its applications. We start at the very beginning, so no prior knowledge is required.

In this three-day training, we cover a wide range of topics. This includes a basic introduction to the concepts and terms of artificial intelligence, modern data management concepts (with a special look at insurance companies), aspects of data protection and the mathematical and statistical concepts of data mining. On our way, we touch different use cases in the actuarial environment. To this end, we provide a brief insight into the widely used language R and development tools in the data science context (RStudio, Anaconda). The seminar rounds off with principles for the ethical handling of artificial intelligence in the insurance environment.

Web Session 'Non-Life Pricing Using Statistical Techniques with R Applications'

on 17-20 February 2025 | 9:00-12:30 CET

Non-Life insurance is facing many challenges ranging from fierce competition on the market or evolution in the distribution channel used by the consumers to evolution of the regulatory environment. Pricing is the central link between solvency, profitability and market shares (volume). Improving pricing practice encompasses several dimensions:

- Technical: Is our pricing adequate to cover the underlying cost of risk of my policyholders and the other costs we are facing? Which are the key variables driving the risk? Are they adequately taken into account in our pricing? What’s the impact of the claims history of my policyholder on its expected risk? In which segment are we profitable and in which are we not profitable?

- Competition: At what price will we attract the segments that we target and price out those that we do not want? Is the positioning of our competitors influencing our pricing practice and our profitability? What’s my position with respect to my competitors in term of pricing? What are the segments in which I am well positioned and the segments where I am not well positioned?

- Elasticity: What price (evolution) are our existing customers prepared to accept? Does the sensitivity to price evolution depend on the profile of my customer?

- Segmentation: Is our segmentation granular enough for our purposes?

The aim of this web session is to present some advanced actuarial/statistical techniques used in non-life pricing or underwriting. The web session focuses on selected practical problems faced by pricing actuaries and product managers.

Web Session 'Actuarial Data Science – Immersion'

on 24-26 February 2025 | 9:00-17:00 CET

Organised by the EAA – European Actuarial Academy GmbH in cooperation with the Aktuarvereinigung Österreichs (AVÖ).

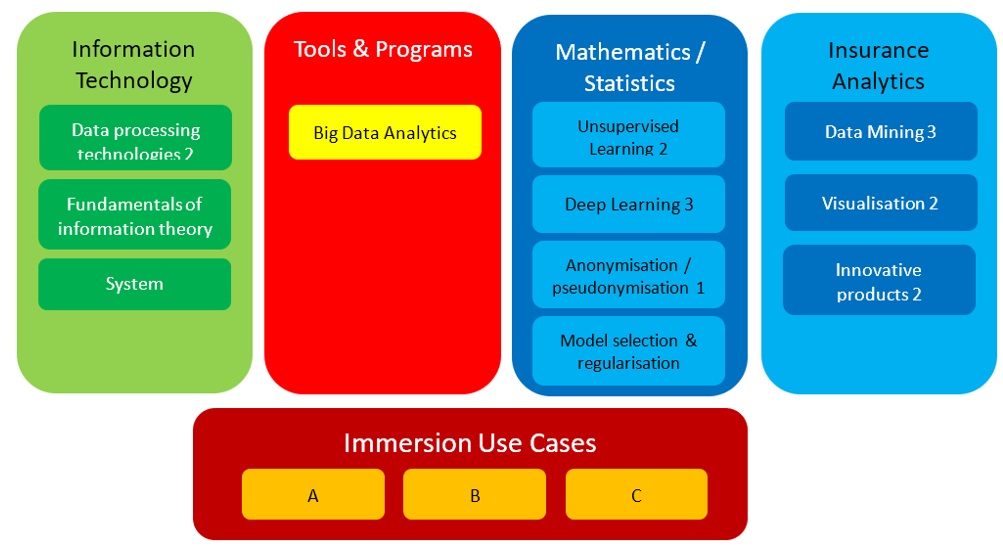

Based on the building blocks known from Basic and Advanced, we want to deepen some topics and present further important topics from the field of Actuarial Data Science.

In this three-day training, we cover a wide range of topics. This includes an advanced introduction to the concepts and terms of artificial intelligence, concepts of information theory, aspects of data protection, some mathematical and statistical concepts, and gives insights into innovative products (with a special look at insurance companies). On our way, we touch different use cases in the actuarial environment.

This is part three of four courses (seminar and exam) to obtain the additional title Certified Actuarial Data Scientist by the AVÖ and/or DAV. Participants who do not hold an AVÖ or DAV membership have also the opportunity to obtain a newly established EAA Certificate in Actuarial Data Science by taking part in all four modules and the corresponding exams.

Web Session 'The UBI Motor Insurance Telematics Pipeline Blueprint'

17 March 2025 | 9:00-12:30 CET

The nature and requirements of motor telematics remain somewhat elusive to the industry as many skills and concepts are not part of the classical syllabus of the profession; while time series data has a fixed place in the profession, dealing with (physical) sensor data has not, much less when extracting risk measure features from it.

The purpose of the seminar is to establish the possible steps from data collection to pricing in order to highlight both the unique challenges as well as opportunities of usage-based insurance (UBI). To this end, a possible pipeline from data collection and feature engineering to risk profiling and finally pricing will be central to this training, but an outlook toward actual motor pricing that incorporates telematic observables is included as well.

The topic is broken down into an introduction of general concepts and some aspects from the relevant literature, a chapter on data collection and preprocessing, a chapter on feature engineering incorporating the unique sensor qualities in play and a chapter on evaluating risk with telematic risk measures extracted from driving data.

Web Session 'SII-Review: Completion of the Framework'

18 March 2025 | 10:00-12:00 CET

Solvency II-Review was initiated in February 2019 with Commission’s request for technical advice to EIOPA. In November 2024 European Parliament and Council have now adopted the amended Solvency II-Directive and the Insurance Recovery and Resolution Directive as well. Within 24 months after publication in the Official Journal of the European Union, member states will have to amend national law to achieve compliance with this new regulation. Entry into force could be January 2027. The Directive is a Level1 document in the hierarchy of the Solvency II framework. Commission is empowered to lay down technical details in Delegated Regulation or Technical Standards to complete the prudential framework. Existing delegated regulation, regulatory or implementing technical standards and Guidelines will need amendments as well.

A considerable number of consultation papers has already been published. More can be expected in the following months.

These and more general topics affecting the task of actuaries will be discussed as well.

This web session will deal with the following topics:

• Amendments of the SII-Directive

• Expected amendments of Delegated Regulation and Technical Standards

• Fundamental components of the IRRD

Web Session 'Building an Interpretable Machine Learning Model'

21 March 2025 | 10:00-12:00 CET

In this web session we introduce an Explainable Boosting Machine (EBM) model that combines both intrinsically interpretable characteristics and high prediction performance. This approach is described as a glass-box model and relies on the use of a Generalized Additive Model (GAM). In this web session, rather than explaining Machine Learning models, we aim to build models that are intrinsically interpretable.

Firstly, we recall the parametric structure of the GLM model as well as the non-parametric structure of Machine Learning models. Some general principles of Machine Learning methods are also presented such as model aggregation.

Secondly, we focus on the GAM model and its declinations. We present its semi-parametric structure and the smoothing-learning paradigm within the shape functions. The EBM model is then introduced as an example of GAM combining Machine Learning functions.

The third part gives a general overview of interpretability techniques and aims to position the EBM interpretability among them.

Lastly, we provide an application of EBM using a Jupyter notebook designed around a P&C actuarial use case.

Web Session 'Non-Financial Statement'

28 March 2025 | 9:30-11:30 CET

Purpose and Nature of this web session:

- Understand the importance and context of Non-Financial Information Statements: Identify the role non-financial information plays in corporate transparency and accountability, as well as its impact on stakeholders’ perception and relationship.

- Learn about international and national regulations and reference frameworks: Become familiar with regulations, such as the European Non-Financial Reporting Directive and the Global Reporting Initiative (GRI) guidelines, and how to apply them in preparing EINF.

- Develop skills for preparing EINF: Learn best practices and methodologies for collecting, analysing, and structuring non-financial data, facilitating its inclusion in the company’s reports.

- Evaluate and communicate environmental, social, and governance (ESG) impact: Acquire skills to present the organization’s sustainability indicators, social performance, and governance practices clearly and effectively.

- Promote transparency and compliance: Ensure that non-financial reports meet expectations and regulations, strengthening investor trust and the organization’s reputation.

- Foster a corporate culture of responsibility and sustainability: Promote understanding and commitment throughout the organization toward responsible business practices, considering long-term impacts on society and the environment.